The value of property for tax purposes is determined by BC Assessment Authority, which is established under provincial legislation and is independent of the municipality.

Property assessment is the determination of a property's market value as of July 1 of the prior year. BC Assessment Authority annually mails to each property owner, a property assessment notice, which shows the property's market value and other important information about the property. If you feel your assessment is incorrect, contact BC Assessment Authority in January to file an appeal.

Provincial and local governments use property assessments to determine what tax rate they must set to raise the revenue needed to pay for public services. Tax authorities set tax rates that are applied to the assessed value of properties, which is subsequently shown on your tax notice.

Provincial and local governments use property assessments to determine what tax rate they must set to raise the revenue needed to pay for public services. Tax authorities set tax rates that are applied to the assessed value of properties, which is subsequently shown on your tax notice.

BC Assessment provides property assessment information for individual properties as well as neighbourhoods and sales data.

More information on your assessment is available on the BC Assessment Website, or contact their office at 1-866-825-8322 or by email at fraservalley@bcassessment.ca.

Your Assessment Notice (bcassessment.ca)

An excellent resource for residents with a breakdown of how their assessments work is found at Assessment Notice Help - Residential (bcassessment.ca)

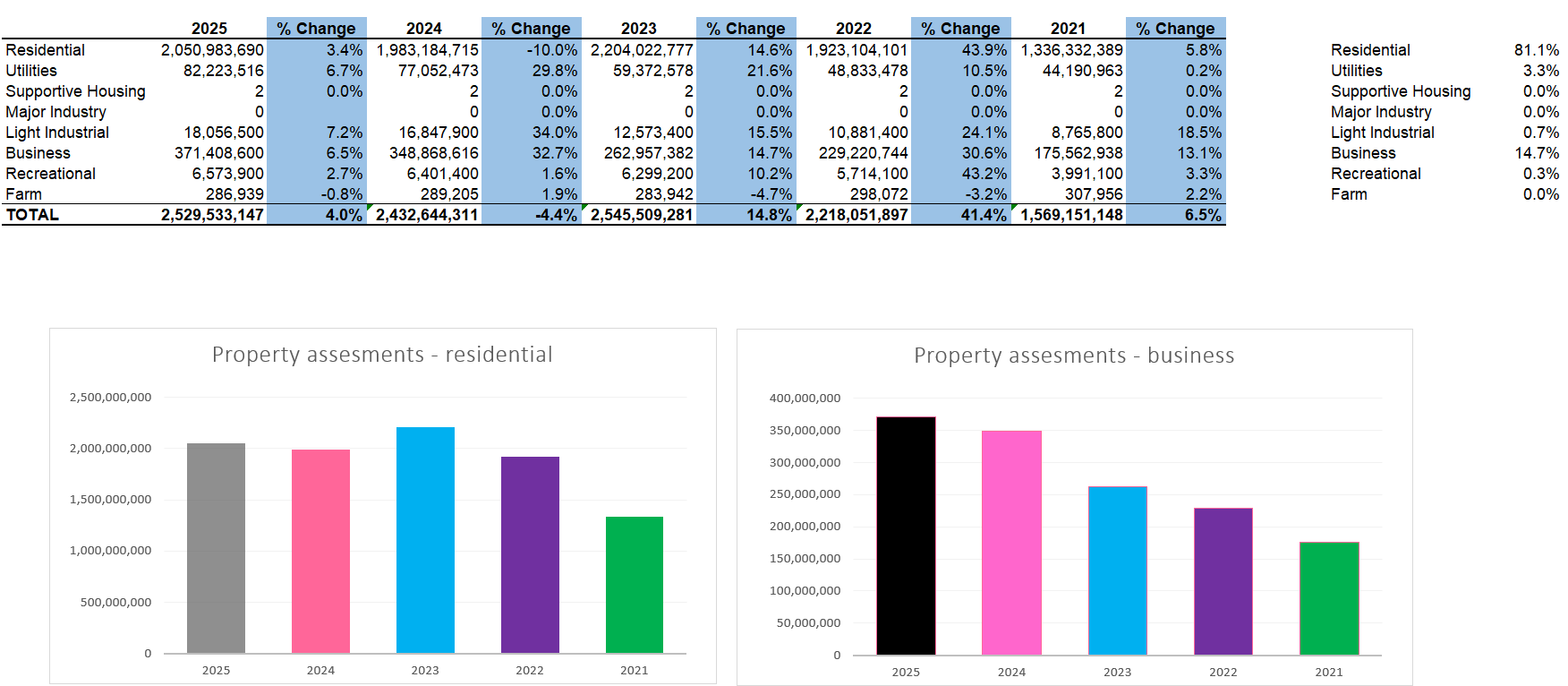

Below is the assessed value comparison for the past five years.